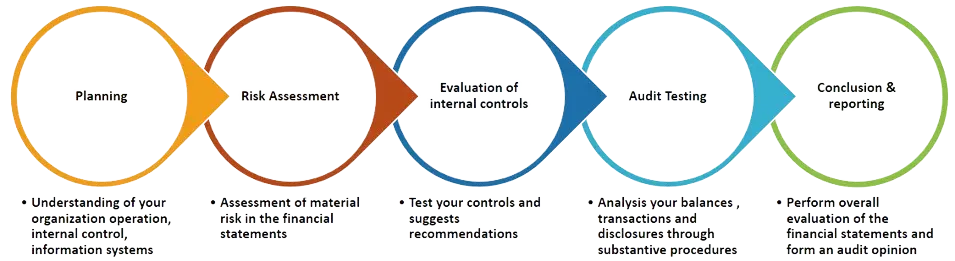

we have developed our own unique audit methodology, based on the International Standards on Auditing (ISA). This methodology allows us to deliver high-quality results with greater efficiency, leveraging modern audit techniques while ensuring compliance with global standards. Our approach is designed to be proactive, with constant communication and early warning alerts to ensure transparency and prevent any surprises during the audit process.

Our Audit Focus

List and describe the key features of your solution or service.

Documentation

All necessary supporting documents, records, and accounts have been kept in respect of the financial transactions of the Entity and the financial statements are in agreement with the books of accounts maintained in accordance with International Financial Reporting Standards.

Fraud and Corruption

In accordance with ISA 240 (The Auditor’s Responsibilities Relating to Fraud in an Audit of Financial Statements), the audit shall identify and evaluate risks related to fraud, obtain or provide sufficient evidence of analysis of these risks and assess on the risks if any identified or suspected.

Governance

Communicate with the Entity’s management responsible for Governance regarding significant audit issues related to governance in accordance with ISA 260: (Communication with those charged with Governance).

Safeguarding of assets

Tailor the platform to your needs, offering flexibility and control over your user experience.

Expenditures

The audit will be conducted not on the sample test check basis but a full check on the total amount utilized. Verification of all expenditure vouchers (60%) which will include adherence to internal delegation of authority and codes.

Financial Transactions

We will examine the eligibility and correctness of financial transactions during the period under review and account balance at the end of the reporting period; and adequacy of internal controls over the operation of the account.

Laws and Regulations

In preparing the audit approach and in executing the audit procedures, evaluation of entity’s compliance with the provisions of laws and regulations of Myanmar that might impact significantly the Entity’s financial statements as required by ISA 250 (Considerations of Laws and Regulations in an Audit of Financial Statements). Although full investigation of due diligence of laws and regulations is not covered, we will include our findings on compliance of laws which would come to our attention during the course of audit.